AN ANALYSIS OF CASH DEPOSIT PATTERN IN COMMERCIAL BANKS FROM 1998 – 2007 (A CASE STUDY OF FIDELITY BANK PLC, OWERRI)

ABSTRACT

The success or failure and effectiveness or ineffectiveness of any banking or financial sector depend on the extent of customer patronage and the financial resources available to form and procure the required service-oriented facilities. In Nigeria, there are lots of problems associated with banking.

The problems include inadequate financial capacity, that is the weak capital base, lack of sound technical planning, the bad implementation of formulated policies linking the banking operations, inadequate supervision and monitoring of economic changes, and large scale financial embezzlement. Due to these problems, many financial firms are distressed and subsequently are closed up… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

INTRODUCTION

The need to monitor, evaluate, and make adequate plans for the future compels managers, scientists of various calling, and researchers alike to collect data on a regular basis on processes that vary as time passes. Observations on such processes when arranged in chronological order (in time sequence) are called time series.

A time series is a group of data that has been collected successively over a period of time. Some examples of time series are the daily cash deposit of customers, the weekly recorded cash deposit of the bank, and the weekly or monthly stock levels of a company, the number of patients treated by a particular hospital per annum. The method of analyzing and interpreting these data is referred to as time series analysis. Time series analysis is very important in business and economic for forecasting purposes.

As we tend to base our forecast of cash deposit results on what has happened in the past. The statistical series which tells us how data has been behaving in the past is the time series. It gives us the values of the variable we are considering at various points in time each year for the last ten years. Time series may be classified as follows:

SECULAR TREND: This is referred to as the general direction in which the figures appear to go over a long interval of time. It is important to distinguish between trends resulting from cyclical influence on the economy. For example, a change in the task of customers buying habits. The observation of a secular trend might show an upward trend or downward trend or a steady trend… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Statement of The Problem

Cash deposits and withdrawals are the main determinants of banks’ financial status. In a highly competitive industry like the banking sector, this issue posses some serious challenges and responsibilities to the banking sector which also the fidelity bank plc Owerri is a victim… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Research Objective

To examine the cash-deposits pattern of fidelity bank, which forms the basis for its growth… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

LITERATURE REVIEW

Introduction

The principal source of funds for commercial banks in Ghana is the deposits they mobilize from households and other company surpluses. According to a lecture produced by Dighe (2005), deposits form 63% of commercial bank liabilities. This indicates that factors that affect deposits mobilization have a huge impact on the performance of commercial banks.

Developing economies are characterized by unstable macroeconomic environments such as inflation, inappropriate fiscal and monetary policies, interest rate controls (Kose et. al. 1999). The net effect is the change in liquidity which affects savings and capital formation. Where the macroeconomic environment is favorable to savings then the commercial banks are in a better position to increase savings.

On the contrary, where macroeconomic policies erode liquidity from the hands of the people then deposits reduce and may negatively impact on capital growth and investment in the country. This chapter seeks to examine the concept of liquidity, the macroeconomic factors that affect cash deposit pattern, and the effects of cash deposit pattern on capital growth and investment in an economy.

The Concept of Liquidity.

Liquidity has diverse meanings according to the context within which it is used. Jason (2001) in his article “Liquidity: Advanced Trading Concept” defines it to be the ease at which assets can be turned into cash. The faster an asset can be turned into money, the more liquid it is (Freixas et. al 1998)… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Macroeconomic Factors that Affect Cash Deposits Mobilisation

The macroeconomic factors that affect money in circulation and consequently cash deposit with the banks discussed in this piece of work are interest rates, fiscal policy, monetary policy and inflation.

Interest Rate

Interest rate is the price for money that depositors receive from the bank. This is the opportunity cost of capital that savers/borrower receive/pay by lending to/borrowing from the financial intermediaries. With regards to cash deposit pattern the ruling interest rates attracts more deposits when it is comparatively higher than the rate of investment. In the developing countries the trend of the government has been the use of interest rate ceilings as a regulatory mechanism to provide cheap credit to SMEs (World Development Report (1989).

Regulation of interest rate below the competitive market interest rates by government legislation leads to capital flight by the international investors especially where portfolio investment is significant and withdrawal of cash deposit domestically (Gilbert et al, 2001). McKinnon-Shaw (2001) hypothesis also confirms that regulating interest rates at or below the equilibrium damages economic development by reducing incentive to hold financial assets and encouraging unnecessary credit rationing.

This hypothesis further argues that freeing interest rate as part of the liberalisation policy will promote cash deposit pattern and ensure efficient allocation of credits to the sectors where returns can be maximized (Laurenceson , 2007)… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Taxation

Fiscal policy relates government revenue to its expenditure. In Ghana taxation is the main source of government revenue and the effectiveness of which rests on its ability to generate required revenue and support investment (Tanzi, 1991). Taxation is often defined as „the levying of compulsory contributions by public authorities having tax jurisdiction, to defray the cost of their activities‟. No specific reward is gained by the tax payer.

The money collected is used for the common good of the citizenry -for the production of certain services, as aforesaid, which are considered to be more efficiently provided by the State rather than by individuals e.g. maintenance of law and order at home, and defence against external enemies, etc. (Ali-Nakyea, 2008)… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Government Expenditure

Government expenditure refers to all monetary expenditure on goods and services made by the government on behalf of the community. It includes both recurrent and capital expenditure on items like health, education, administration and so on. The recurrent expenditure refers to the expenditures that occur at regular intervals in the annual budget of the government.

These expenses include expenditure on defence, administration and debt servicing particularly payment of interest on loans, road maintenance, and cost of health and education services. Capital expenditure on the other hand, is the expenditure incurred on capital project.

That is, it is the cost of major projects which will not be a regular expense in future years. It includes expenditure on fixed assets like construction of dams, new school building, new roads, hospital building and other expenditure on productive ventures such as agricultural, industry and mining… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

The Link between Deposits Mobilization, Investment and Capital Growth

Investments and savings in Ghana have been classified as low and this has been attributable to low incomes and the inability of the financial institutions to mobilise investment funds locally (Loayza et al, 1998). Investment and capital growth in the country are dependent on the ability of the financial intermediaries to mobilize deposits from saver and prudently lending them to firms and individual borrowers (World Development Report, 1989).

This section examines the relationship between deposits, investment and capital growth. One of the arguments in favour of capital account liberalisation is widening the scope within which banks can mobilize more resources for investment (Gilbert at al; 2001) (Fry, 1997). SchmidtHebbel et al (1996) reviewed in Mussa and Goldstein (1994), Tesar and Werner (1992) that national savings are largely retained in the home country where they increase domestic investment and these are left with the local institutions to mobilise more cash deposit to increase savings… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

RESEARCH METHODOLOGY

This section illustrates the methodology that has been pursued to obtain the desired results as per the stated general and specific objectives.

The most important factor that determines/establishes the research design is the nature of the problem at hand, which is done to accomplish the intended objectives. Due to the fact that; the subject of the study is characterized as multi-dimensional responses, integrated approach is look upon as an appropriate methodology. Thus, to generate necessary information and come up with more rich and comprehensive data, both qualitative and quantitative approaches (Mixed approach) were employed.

The former approach might be focus on examining the real experiences of the respondents including their own expression and articulation with more subjective views, whereas the latter mostly concentrate on the critical interpretation of quantifiable empirical data. The rational for which selecting the integrated approach is due to the fact that evaluating the challenges and prospects of pattern of cash deposit require multifaceted patterns… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Multiple Regression Model

The type of the data for this study is time series for 9 years of data in the regression analysis from 1998-2007. The model is multiple regression models with one dependent variable and four independent variables:

Per Capita Income (PCI): (This is real GDP per capita income of people). Various economic theory and empirical evidences confirms that an increase in people income influences positively their savings capacity.

Investment (Inv): Investment and savings are more interrelated macroeconomic variables that feed each other. In most cases savings support investment as an input. On the other side investment creates job opportunity for people, adopts new technology, and improves standards of livings at national level. The expected sign here is positive… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Diagnostic test methods

The assumptions were made relating to the classical linear regression model (CLRM). These were required to show that the estimation technique, ordinary least squares (OLS), had a number of desirable properties, and also that hypothesis tests regarding the coefficient estimates could validly be conducted. The method used to test these assumptions by the researcher is described as follows:-

The average value of error is Zero

The first assumption required is that the average value of the errors is zero. In fact, if a constant term is included in the regression equation, this assumption will never be violated. But if the regression did not include an intercept, and the average value of the errors was non zero, several undesirable consequences could arise. (Brooks, 2008)… (Scroll down for the link to get the Complete Chapter One to Five Project Material)

DATA ANALYSIS AND DISCUSSION

This part of the research is presented into two parts, the first part is an analysis of quantitative data and the second part is the qualitative data analysis. The quantitative data is obtained from the Central bank of Nigeria and multiple regression method is conducted. The second part is the qualitative data analysis and presentation which is obtained from the responses obtained from the questionnaires distributed.

This section presents the empirical findings from the econometric result for the challenges and prospects of cash deposit pattern in Nigerian Fidelity Bank PLc. The model for Dependent variable, Total cash deposit of Fidelity Bank Plc and independent variables has been tested for the assumptions of the classical linear regression model (CLRM) before interpreting the result. According to the test results, the model satisfies all the assumptions for the CLRM which is discussed here under. These tests are indicated under the following sections.

Test Results for the Classical Linear Regression Model Assumptions

In this study as mentioned in chapter three diagnostic tests were carried out to ensure that the data fits the basic assumptions of classical linear regression model. Consequently, the results for model misspecification tests are presented as follows:

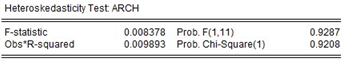

- Test for Heteroskedasticity

Ho: The assumption that there exists homoscedasticity

H1: There is no homoscedasticity (there is Heteroskedasticity)

In this study as shown in table 4.1, both the F-statistic and Chi-Square versions of the test statistic gave the same conclusion that there is no evidence for the presence of heteroskedasticity, since the p-values were in excess of 0.05. The explained sum of squares from the auxiliary regression, also gave the same conclusion that there is no evidence for the presence of heteroskedasticity problem, since the p-value was considerably in excess of 0.05.

Table 2: Heteroskedasticity test

-

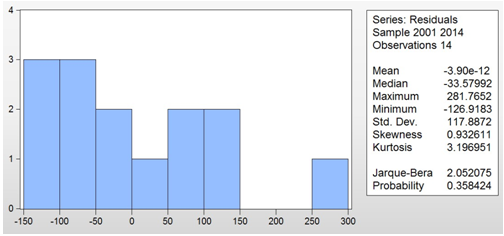

- Test for Normality

Ho: The residuals are normally distributed

H1: The residuals are not normally distributed

The normality tests for this study as shown in figure 4.1, the coefficient of kurtosis was close to 3, and the Bera-Jarque statistic had a P-value of 0.36 implying that the data were consistent with a normal distribution assumption and 36% of the data is normal.

Figure 3: Normal test for residual

(Scroll down for the link to get the Complete Chapter One to Five Project Material)

CONCLUSIONS AND RECOMMENDATIONS

The previous chapter presented the analysis of the findings, while this chapter deals with the conclusions and recommendations provided based on the findings of the study. Accordingly, this chapter is organized into two subsections. The first section presents the conclusions while the second section presents the recommendations.

This study examined the challenges and prospects of analyzing the cash deposit pattern in Nigerian Fidelity Bank PLc. Based on the result of descriptive and empirical analysis, the study had concluded the following:

The external factors such as Age Dependency Ratio, Money supply, and Investment and legal environment affects the operation and performance of financial institutions.. (Scroll down for the link to get the Complete Chapter One to Five Project Material)

Banks should increase creating awareness to peoples because one of the main factors that affect the savings mobilization is literacy of saving of the people. The more the people are educated the higher will be the savings mobilization… (Scroll down for the link to get the Complete Chapter One to Five Project Material)